Global Insights into Consumer Preferences and Concerns About Autonomous Vehicles and Electric Engines

The global automotive industry is undergoing a profound transformation as advancements in autonomous vehicle technology and electric engines reshape consumer expectations. A recent survey(Deloitte) sheds light on regional consumer concerns and preferences regarding autonomous vehicles and engine types, offering critical insights for industry stakeholders.

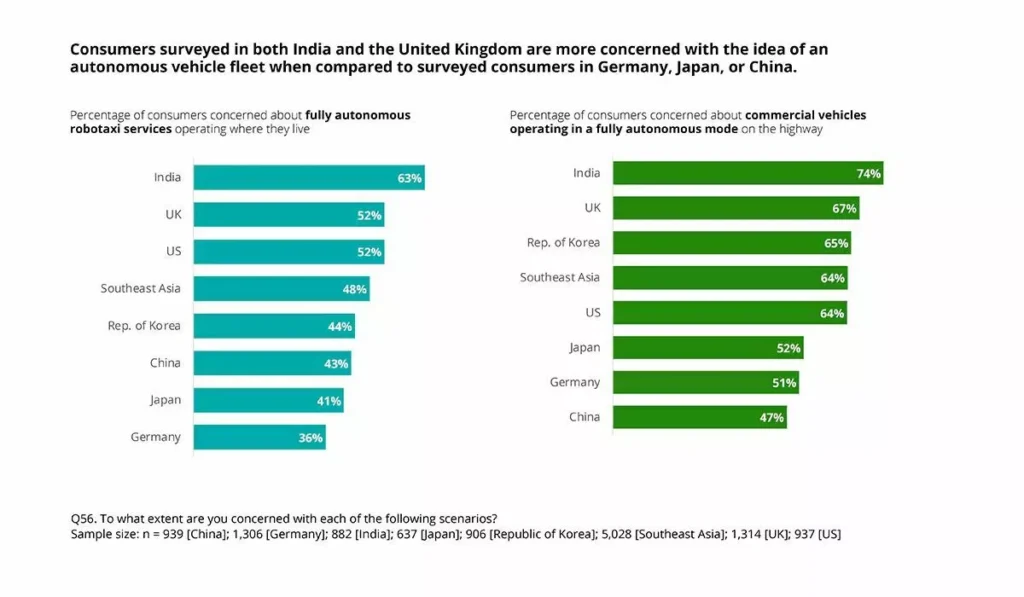

1. Consumer Concerns About Autonomous Vehicles

Autonomous vehicles have sparked a mixed response worldwide, with concerns about safety, reliability, and implementation varying across regions.

- India leads in concerns regarding fully autonomous robotaxi services, with 63% of respondents expressing apprehension. Similarly, 74% of Indian consumers are worried about commercial vehicles operating in fully autonomous modes on highways.

- The UK and US show a significant level of concern, with 52% of respondents in both countries uneasy about robotaxi services.

- Comparatively, countries like Germany (36%) and Japan (41%) exhibit less concern, suggesting a higher level of trust in autonomous technologies or possibly lesser awareness.

These findings underline the importance of tailoring autonomous vehicle strategies to address safety concerns in markets like India and the UK, where consumer hesitation is notably higher.

2. Brand Loyalty and Consumer Switching Intentions

The survey also reveals intriguing insights into brand loyalty and switching intentions:

- China demonstrates the highest likelihood of consumers switching to a different vehicle brand, with 76% of respondents intending to make a change in 2025, up from 73% in 2024.

- India follows closely, with 78% of respondents planning to switch brands in 2025, reflecting a fiercely competitive automotive market.

- On the contrary, Japan has the most brand-loyal consumers, with only 39% intending to switch, though this figure marks an increase from 35% in 2024.

This data underscores the dynamic nature of the Chinese and Indian markets, where brand competition is intense, and consumer preferences shift rapidly.

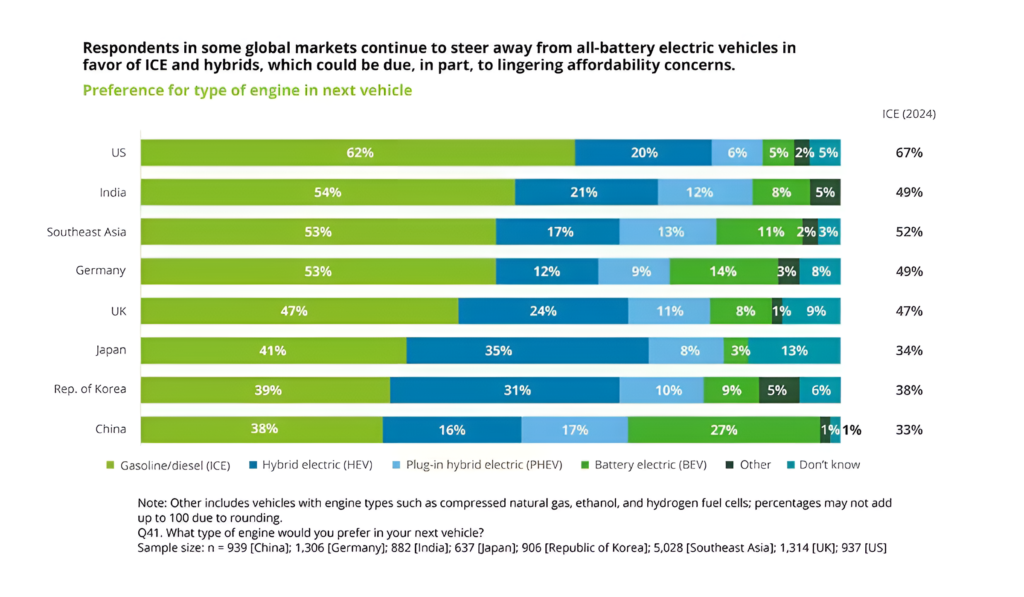

3. Preferences for Engine Types in Future Vehicles

With the rise of environmental consciousness and cost considerations, engine preferences are evolving globally:

- Internal Combustion Engines (ICE): Despite the push toward electrification, ICE remains dominant, particularly in the US (62%) and India (54%).

- Hybrid Electric Vehicles (HEV): Southeast Asia (17%) and Germany (12%) show increasing interest in hybrids, reflecting a transitional mindset among consumers.

- Battery Electric Vehicles (BEV): Adoption rates remain modest, with Japan (8%) and China (16%) showing some preference, but concerns about affordability and infrastructure remain barriers.

Notably, China shows a significant preference for plug-in hybrid electric vehicles (27%), indicating a potential bridge technology as the market moves toward full electrification.

Key Takeaways for the Automotive Industry

- Address Regional Concerns: Markets like India and the UK require robust safety assurances for autonomous vehicles to overcome consumer skepticism.

- Build Brand Loyalty: The intense competition in China and India demands innovative marketing strategies to retain customer bases.

- Enhance EV Affordability: Greater focus on infrastructure development and cost reduction is needed to drive BEV adoption, especially in emerging markets.

The future of mobility is undoubtedly electrified and autonomous, but achieving widespread consumer acceptance requires targeted strategies that align with regional priorities and consumer behavior.